Promotion in Banking and Policy

One of the key elements in the development strategy of the developing countries is productive investment in the private sector. FDI attraction allows the connection of the economy of a country to the value chains in the global economy, and it enables economic upgrading. FDI leads to investment funds, employment, greater exports, supply chain spill-overs, new technologies and practices of law in a business. Although the potential gains of FDI have been well documented, they do not occur in a policy, legal and institutional environment that is not conducive.

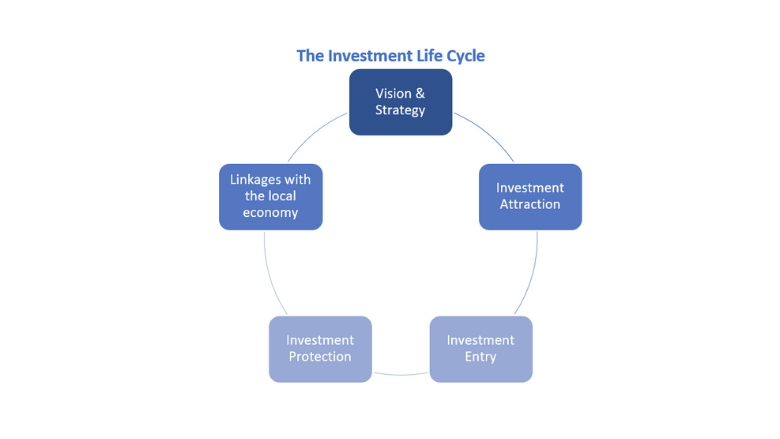

In an international environment that has been significantly disrupted by the impacts of the COVID-19 pandemic, but remains thoroughly an environment of rapid technological change and political uncertainty, countries should be concerned more than ever with ensuring the value of their propositions as destinations of investment. In addition, effective implementation of investment policies and strategies are essential in order to adequately reap the benefits of FDI. By supporting a wide-ranging measure including a legal, regulatory, procedural and institutional issues that impact all stages of the investment life cycle, the World Bank Group assists nations in providing an attractive and competitive investment climate that will foster investment attraction, retention and even investment expansions on a sustainable footing.

Strategy

Developing a Investment Reform Map/ or FDI Strategy:

Analysis and conceptualisation of how to quantify and qualify the quality of FDI being invested in countries and how the countries can best support it through policy mixes and regulations to ensure maximum benefit;

Establishing priorities to develop consistent investment policy and promotion reform agendas and aim at attracting, facilitating and retaining as well as maximizing positive spillovers of FDI in host economy.

Enhance the performance of the policies that seek to attract and encourage entry of FDI:

Strengthen investment promotion capacity, such as the competitive offer supporting investment in priority areas and the outreach and facilitation capacity building;

Assisting countries in the restructuring of their regimes on entry into investment by, among other things, affording nondiscriminatory treatment to investors, relaxing on sectoral restriction and performance requirement and streamlining procedures to achieve development goals.

Read Also: Sgs Clinical Studies Government Scholarship 2025

Yale Computer Science College Scholarship

Raising positive indicators in the efficiency of investment incentives:

Assisting countries in determining how and whether incentives are related to FDI inflows and policy goals including employment creation, gender equality and sustainable growth.

Reinforcing investor faithfulness to assist clients to retain and increase FDI:

Upgrading law and regulations to help in minimizing the political risk by investors;

Designing and setting in place investor aftercare programmes that support growth through retention, expansion and diversification in addition to strengthening connections with local suppliers.

Avoiding investor/state disputes through introducing investor grievance mechanisms

Facilitating best practice in monitoring and addressing major regulatory implementation issues to investment grievance management to retain and expand investment.

Optimizing linkages and positive spillover effects to the host economy of FDI:

Formulating a strategic action plan for FDI linkages to eliminate distortionary policies, the interaction of MNE and local firms, upgrading local firms and the attraction of foreign suppliers.

In practice

- In Ethiopia, six new sectors that were open to FDI were opened. Directly generated FDI came in to the tune of $96m within two years of the reform. The Investment Commission of Ethiopia also incorporated a system whereby the grievances of the investors can be addressed before they are taken to international disputes. This has seen retention of USD 5.4 million in terms of FDI so far.

- The elimination of conditional entry requirements in Myanmar, by a new negative list opening 70 sectors to 100 percent foreign ownership and via a reduction in permitted FDI screening under a unified investment law, saw a six-fold increase in approved FDI projects in FY 13-16 mass, reaching USD 9.5 billion.

- In Sri Lanka, the government has introduced a new inland revenue Act in 2017 to enhance tax transparency and administration as well as get rid of all tax holidays and replaced it with performance-based investment incentives.

- In the period between 2015 and 2018, the above countries namely Jordan, Iraq, Ethiopia, Pakistan, Bosnia and Herzegovina, Armenia, Tajikistan Moldova and Kyrgyz Republic came up with substantial investment incentives inventories that can be normalised with standard criteria in terms of transparency and accessibility, comprehensiveness, and sustainability, giving confidence to investors.

- In Iraq, the creation of investor grievance mechanism through Basra Investment Commission resulted into USD 220 million FDI that was on the verge of divestment.

- In Georgia funds, an amount of USD 80 million was retained as FDI was at risk after the establishment of an Investment Ombudsman.

- In Guinea, a supplier marketplace platform was launched to improve the participation of local suppliers in the mining industry, which was low. 883 local companies (111 owned by women) registered on the platform. 77 percent of posted requests for proposal have been awarded to SMEs registered on the platform.

- A pilot supplier development project in Vietnam resulted in 70% additional capacity by applying new standards and management tools, 50% improvement in profit and turnover and 42 percent developed new relationships with MNE buyers of whom 9 percent were formal MNE suppliers.

- In Mali, Ethiopia, India (Assam), Tunisia and Bosnia Herzegovina, WBG investment promotion support since 2017 has resulted in a combined USD 608 million in investment generated.